9 Questions To Unravel The Questions of To Rent or Buy

Buying a home is probably one of the few life goal and perhaps one of the biggest financial commitments in our lives. We can be stressed over the questions of buying or renting especially for those who have been trying to look for the myriad of house for sales in the market while continuing staying in a rental property.

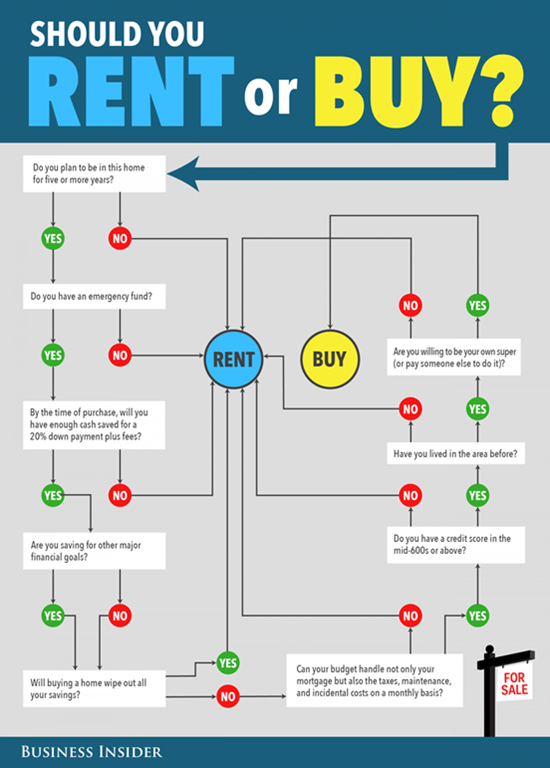

To ease the anxiety, Business Insider has come out with the following flow chart that best unravel the questions that have perturbed most of us. While there’s no universal right answer, but these 9 questions will force you to think thoroughly and complete your decision process.

The 9 questions are:

1. Do you plan to be in this home for five or more years?

The general thumb is you might want to be sure you’ll be in the same location for at least five years. Otherwise, you’re probably going to take a hit financially when you have paid a steep interest in the first few years as well as having to go through the closing stage.

2. Do you have an emergency fund?

Never put all the eggs in one basket. If you are eligible of a mortgage loan and you have secure sufficient fund for the down payment, you might want to see if you will be able to survive for another 6 months to 1 year without any income coming in.

3. By the time of purchase, will you have enough cash saved for a 10-20% down payment plus fees?

For a typical RM500k property in Klang Valley, you will need to fork out somewhere between RM70k and RM185k. The fees are coming from down payment, sale & purchase agreement fees, loan documentation fees, bank processing fee and perhaps a valuation fee.

4. Are you saving for other major financial goals?

If you already have a handsome sum ready to disburse for your home, try to consider other goals you have. Either its for your coming marriage, you have a baby coming soon, you need you invest in your business and etc.

5. Will buying a home wipe out all your savings?

Back to no.2, never spend all your savings in one single goal. Make sure you spend not more than 50% of your savings on your home buying.

6. Can your budget handle not only mortgage but other miscellaneous costs on a monthly basis?

You might be eligible for a home mortgage that might cost you few thousands a month. But do remember that a bank will not take into consideration of your other costs such as the maintenance, incidental costs and your other commitments. Getting a loan approved is always easier than making ends meet.

You have to anticipate a lot of other hidden costs such as utilities fees, house maintenance, staging of your house and of course some incidental costs like repair work and etc.

7. Do you have a good credit score?

You can always get your own credit score sorted out with the help of many financial institutes out there such as CTOS. You will get to understand your credit and monitor your credit health. Again, having a loan approved doesn’t translate to a healthy credit score.

8. Have you lived in this area before?

If its an entirely new area to you, you might want to test the water first to understand whether the area is right for you and your family. That being said, you might want to rent a place in that area and stay for a bit before making a hasty decision.

9. Are you willing to be your own super?

This is not about financial anymore but rather a lifestyle question. You have to anticipate numerous situations that might come in your way such as a leaking sink, a broken doorknob, ants situation and etc. You will no longer have a landlord or super to handle it for you but rather you are on your own. Of course, unless you are hiring someone to handle for you.

source: www.businessinsider.com/buy-or-rent-a-home-flowchart-2016-7

nice sharing Illy ^_^

ReplyDelete